RA NPV Forecast Calculator. Wolfe Corporation CAPM risk-adjusted net present value simulation Investment in a security Risk-adjusted net present value Scenario analysis and risk-adjusted NPV Kaimalino Properties KP IRR NPV capital limits.

Solved Chapter 11 Problem 20sp Solution Foundations Of Finance 9th Edition Chegg Com

Risk-adjusted NPV Risk adjusted NPV The risk adjusted NPV Country risk assessment Risk-adjusted NPV for G.

. All rights reserved. In the Main menu go to Tools RA NPV forecast. Each will require a net investment of 5000.

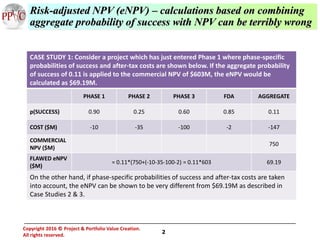

Risk-adjusted NPV eNPV calculations based on Decision Tree analysis with phased risk and cost decomposition II CASE STUDY 3. Present Value of Cash Flows formula and calculations. NPV Calculation Step 1.

Risk adjusted net present value is little different from normal net present value. NPV Net Present Value Derived Risk 100. BioHeights has launched a Risk-Adjusted NPV calculator for an investigational product.

1- Probability Technical Success 1 Probability Commercial Success 2. 110105 or 11105 which equals 09535. Year 3 10 million 15 3 1158 million.

The Risk-Adjusted Net Present Value RA NPV is a useful metric to compare several programs in terms of their risk and value. For example an early-stage ie riskier product with higher revenue potential may be as attractive. To begin with firstly arrange all future cash flows corresponding to each year of.

80 and pcs 50. Enter the variables of your investment in the Excel formula. Year 1 10 million 15 1 105 million.

But for calculating risk adjusted net present value eNPV we use risk adjusted return on investment as cut off rate. For example a first-year cash flow estimate. Apv pv cf pv ts apv apv.

Nominal cash flows are calculated for each year as follows. A common tool used to calculate a risk-adjusted discount rate is the capital asset pricing model CAPM. Examples of NPV Net Present Value Net Present Value NPV refers to the dollar value derived by deducting the present value of all the cash outflows of the company from the present value of the total cash inflows and the example of which includes the case of the company A ltd.

The Adjusted Present Value apv is. Full Excel Model - BASIC 12995. Using a discount rate of 10 percent this results in a present value factor of.

Therefore NPV is -100000 30000 13 13076923. They are first adjusted with the risk factor and then used to calculate. The Pharma Biotech Valuation Model Template calculates the risk-adjusted DCF Value of a Pharma or Biotech Startup Company with several.

Under this model the risk-free interest rate is adjusted by a risk premium based upon the. Derived Risk 35. Is considering the development of one of two mutually exclusive new computer models.

As per formula used in BI reports for deriving Risk Adjusted. Full Excel Model - PREMIUM 19995. Alternatively companies could use discounted cash flow techniques such as Net Present Value NPV and Internal Rate of Return IRR.

The sum of all the individual present. Risk-Adjusted NPV Real Time Systems Inc. NPV with Inflation.

Risk-adjusted NPV also known as rNPV does not use the estimates of future cash flows as it is in the calculation. Value 1 and Value 2 are the cash flows of the project. NPV Initial Investment Annual Return Return on Equity.

NPV 100000 INR. Risk 1 80 1 50 2. The same data as Case Study 1 except that Phase 2 and Phase 3 probabilities of success are switched without changing the aggregate probability of success and using Decision Tree analysis the eNPV.

For example an early-stage ie riskier product with higher revenue potential may be as attractive as a late-stage. Net Present Value Method Calculation Steps. Plugging in the numbers from the table we have the following formula.

RNPV modifies the standard NPV calculation of discounted cash flow DCF analysis by adjusting multiplying each cash flow by the estimated probability that it occurs the estimated success rate. The cash flow figures for each project are shown below. Adjusted Present Value Unlevered Firm Value NE where.

PDF Demo Previews 000. This risk adjusted return on investment is. Multiply this by the relevant cash flow and repeat this step for all potential cash flows.

The companys CFO has asked you to calculate NPV using a schedule of future nominal cash flows. NE Net effect of debt beginaligned textAdjusted Present Value Unlevered Firm Value NE textbfwhere textNE. Its important to understand exactly how the NPV formula works in Excel and the math behind it.

This page looks at how to take account of inflation when using NPV techniques. Pv cf cfr a mr - r100 - pc - 100 - 100 - 100 - - - pv cf Present Value of Tax Shield formula and calculations. In normal net present value we just use normal cut off rate for calculating present value of cash inflows and present value of cash outflow.

NPV 8 -100000 6000 6000 6000 120000 This gives you a NPV of 22064. Pv ts e tcod pv ts pv ts pv ts pv ts Adjusted Present Value formula and calculations. Where the present value of all the cash outflows is 100000 and the present value of the total Cash.

In the language of probability theory the rNPV is the expected value. Plus the present value of debt financing costs. NPV F 1 rn where PV Present Value F Future payment cash flow r Discount rate n the number of periods in the future.

The following paragraphs enumerates steps involved in calculating net present value npv. Determining the risk-adjusted net present value rNPV like NPV also involves forecasting the revenues cash inflows costs cash outflows and their respective timing but additionally requires the relevant success rate s for each stage of development. Year 2 10 million 15 2 113 million.

For the house in the safe neighbourhood it would look like the following. Pharma Biotech Valuation Model Template Risk-Adjusted Average rating. When appraising capital projects basic techniques such as ROCE and Payback could be used.

This Risk-Adjusted Net Present Value RA NPV forecast calculator is a useful metric to compare several programs in terms of their risk and value. Risk-Adjusted NPV forecast model with Basic and Advanced inputs one indication one geography.

Using The Net Present Value Npv In Financial Analysis Magnimetrics

How Is Risk Related To Net Present Value Npv Efinancemanagement

0 Comments